Calling All Companies: To IPO on Nasdaq or NYSE?

30.10.2018

Author: Amiti Rothstein

Which U.S. stock exchange should your company use for its IPO? Aside from technical differences in the manner in which listed common stock/ordinary shares are traded, why would a company choose one over the other? The following review takes a look at just a few of the conceptual reasons as to why companies may choose one of these two exchanges over the other, as well as a brief overview of the initial financial and liquidity listing standards and fees associated with an IPO on each of these two exchanges.

Differences Between Nasdaq and NYSE

Exchange Perceptions

The companies whose shares are listed on the NYSE are perceived to be less volatile (NYSE claims that its model results in 40% less volatility on a given listing day) and as such the exchange is believed to list “blue chip” companies whose stock is considered to be more stable and established (think Berkshire Hathaway, IBM, General Electronic, etc.), whereas Nasdaq is perceived as a high-tech market (which, based on the statistics described above, is not necessarily true), attracting more high-growth companies (e.g., the “FANG” companies are all listed on Nasdaq).

Even so, the NYSE is just as involved with listing tech companies as Nasdaq. According to Dealogic, NYSE’s share of the number of tech deals has boomed in recent years, up from the single digit share that it held in the 1990s, to over 50% of such deals from 2013 to 2015. More recently, Dealogic reported that in 2017 both exchanges had 18 tech IPOs, but NYSE had a total volume of $9.9 billion compared to only $2.4 billion on Nasdaq. Dealogic further reports that although since 2010 Nasdaq has gained more tech listings than NYSE (183 vs. 160), NYSE has had the bigger initial public offerings (tech listings on NYSE have raised $74.4 billion vs. $49.6 billion on Nasdaq).

Free Advertising

In addition to the perception associated with the two exchanges, some companies are choosing one exchange over the other based off of location. Kraft Foods (today, Kraft Heinz), which split into two publicly traded companies back in 2012, transferred to Nasdaq both to cut down on costs (its annual fees would be lower on Nasdaq) and for added visibility, with the company claiming that Nasdaq’s Times Square billboard would give its brands (including Oreo and Nabisco) greater visibility.

The Company We Keep

Not necessarily a difference between the two exchanges, but the types of companies listed on each exchange can also have an effect on the exchange a company may pick for its IPO, as certain companies may prefer to list on the same exchange where its counterparts are listed. For instance, PepsiCo., transferred from the NYSE to Nasdaq and by doing so joined other consumer product giants Starbucks, Mondelez and Kraft Heinz.

Initial Financial and Liquidity Listing Requirements

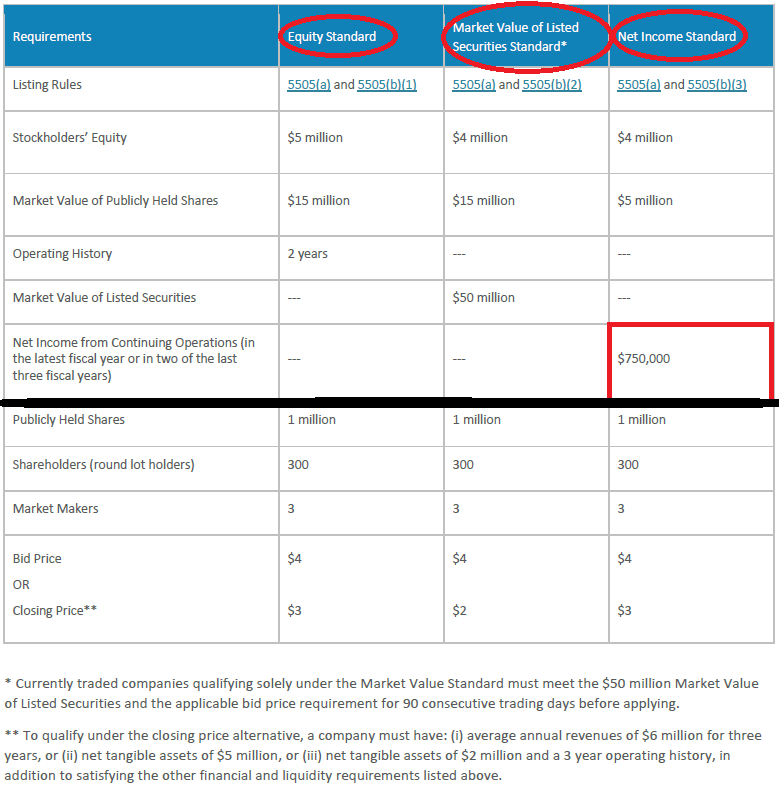

With both of these leading U.S. stock exchanges having the capability and eagerness to list qualifying companies, as they go head-to-head with one another to claim the title as the leading U.S. stock exchange, the following is a very brief overview of the initial standards that a company must achieve in order to qualify to list its shares of common stock/ordinary shares on the Nasdaq or NYSE. Both Nasdaq and NYSE have market tiers and as such, the following analysis of initial listing standards assumes the lowest tier of each of the aforementioned stock exchanges – the Nasdaq Capital Market and NYSE American.

Source: Nasdaq

As shown in the above table, there are three different standards under which a company may qualify to list its common stock on Nasdaq. Regardless of which standard a company uses to qualify for listing, the minimum threshold for the number of publicly held shares, shareholders, market makers, and the minimum bid price are all identical.

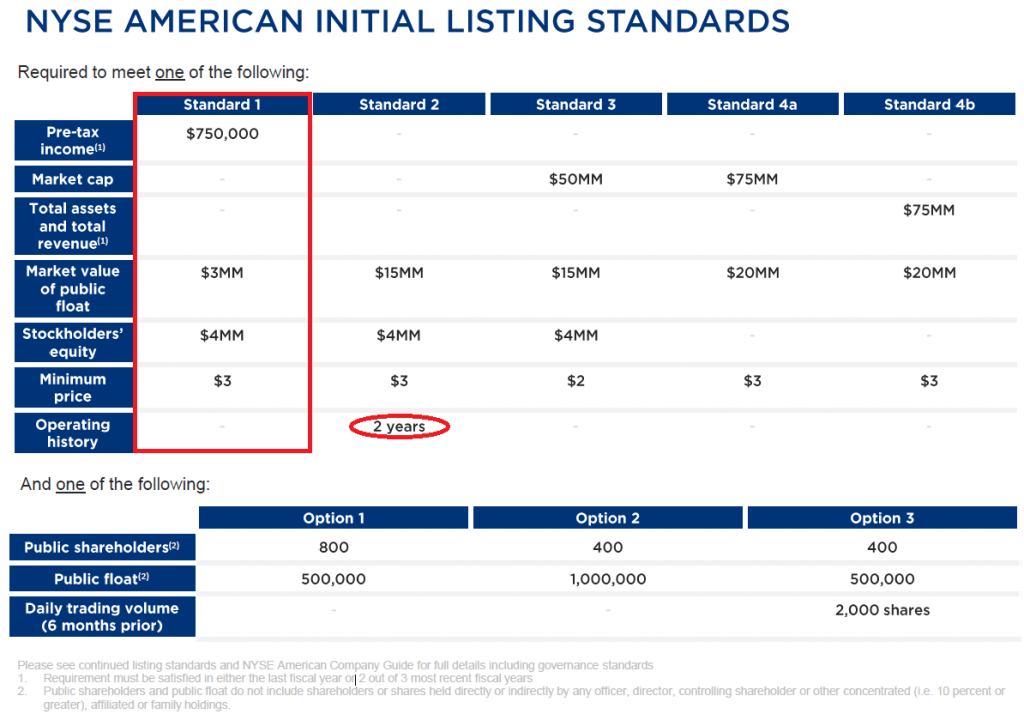

Source: NYSE

Comparing the requirements set by both stock exchanges, for companies that meet the minimum annual income (from continuing operations), the NYSE’s listing standards may be considered easier to achieve, with thresholds for lower market value of public float and minimum price (but requiring more public shareholders).

Companies that do not meet the annual income threshold (Nasdaq – Net Income Standard, NYSE – Standard 1), but have an operating history of two years may be able to meet he listing requirements through the Nasdaq Equity Standard or NYSE’s Standard 2, both of which may be the most achievable thresholds for companies looking to IPO. Of the two said initial listing standards, the NYSE standard requires a lower minimum price ($3 vs. Nasdaq’s $4) and stockholder’s equity ($4 million vs. Nasdaq’s $5 million).

Regarding the Nasdaq’s $4 minimum bid price standard (Nasdaq Rule 5505), there is an exception, whereby under Nasdaq Rule 5505 a company may qualify to list on the Nasdaq with a price per share of only $3, if the company meets the requirements of the Equity or Net Income Standards, or $2 per share, if the company meets the requirements of the Market Value of Listed Securities Standard, provided that, in each case, the company meets additional financial requirements.

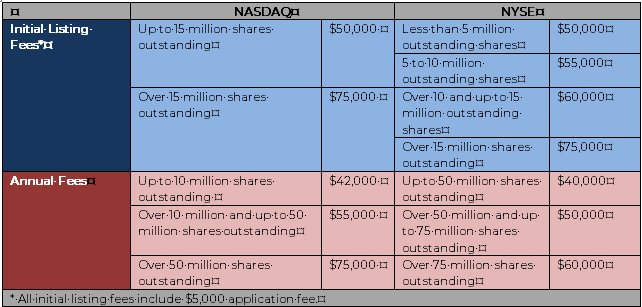

Filing Fees

If the initial financial and liquidity standards are not roadblocks for getting listed, then companies should also consider the listing and general, basic annual fees owed to each of the two exchanges.

Nasdaq or NYSE?

Understanding the initial listing standards and basic filings fees is just one step in the IPO process, and more specifically, just the first step in determining which of these two leading U.S. stock exchanges is best suited for the listing of your common stock/ordinary shares (and/or other securities). Any company, tech and non-tech, looking to IPO needs to do determine which exchange’s ongoing governing rules are more appropriate for it, and from a business point of view, which exchange, if either, provides certain added value that elevates that exchange above the other.