IVC Research Center and ZAG Report: Israeli High-Tech Companies Raised $1.55 Billion in 128 Deals in Q1/2019

16.04.2019 | ZAG-S&W

Summary of Israeli High-Tech Company Capital Raising – Q1/2019

IVC Research Center and ZAG Report:

Israeli High-Tech Companies Raised $1.55 Billion in 128 Deals in Q1/2019

Key facts:

- C round deals soared—$476m raised in 17 deals—highest figures since 2014

- Median deal size climbed to $6 million in Q1/2019 due to five deals over $50m each

- Two deals larger than $100m each captured 16% of the total capital

- Significant growth in Artificial Intelligence companies—$599m raised in 51 deals—almost doubling Q1/2018 numbers

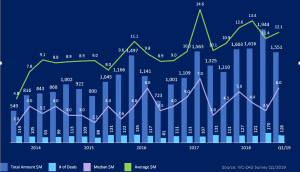

Tel Aviv, Israel, April 16, 2019. In Q1/2019, Israeli high-tech companies raised $1.55 billion in 128 deals. Following an unusually active Q4/2018, the first quarter of 2019 continued the uptrend. Israeli high-tech companies raised 28% more in capital amounts and 15% more in the number of deals compared to Q1/2018. Amount raised and deal numbers in Q1/2019 were on the high end of previous quarter ranges.

The median deal size reached $6 million in Q1/2019 thanks to five mega financing deals over $50m, two of which were larger than $100m each: Innoviz ($132m) and DriveNets ($110m). The two mega-deals captured 16% of the total capital raised in Q1/2019.

Chart 1: Israeli High-Tech Capital Raising Q1/2014–Q1/2019

Capital Raising by Rounds and Stages

Investment trends in the Israeli high-tech continued with the same pattern of the last quarters. Investors preference for less risk and moderate returns drove the uptrend in late stage and bigger financial rounds in Q1, as earlier stage rounds with lower amounts kept past levels after peaking in Q4/18.

In Q1/2019, seed round amounts declined to $51m compared to $94m and $54m in Q4 and Q1/2018, respectively. The number of seed round deals (28) were in historical quarterly ranges of 2014–2018.

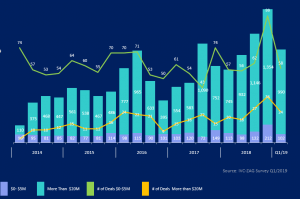

According to IVC’s analysis, while amounts raised in later round deals dropped to nearly $206m in 17 deals in Q1/2019, C round deals soared, raising $476m in 17 deals—the highest figures in both deals and amounts of the past four years. Capital-raising in deals larger than $20m attracted 64% of the total amount in Q1/2019.

Chart 2: Israeli High-Tech Capital Raising by Deal Size Q1/14–Q1/19

Shmulik Zysman, Founder and Managing Director at ZAG says that: “Israeli high-tech opened the year 2019 with momentum. We are particularly optimistic as the first quarter of 2019 was the most successful first quarter in the past six years, both in terms of total funding and number of transactions. Another reason for optimism is the high involvement of venture capital funds in the amount of capital invested – one of the highest in the last five years”.

According to Zysman: “In the first quarter we have seen the continued trend of “less venturous venture capital”. This trend is evident in the increase of the amount of capital invested in mid and late stage companies. This contrasts with a certain decline in the capital amount invested in seed and early stage companies”.

Capital Raising by Deal Type

Seventy-one VC-backed deals attracted more capital, reaching $1.3 billion in Q1/2019. The number of VC-backed deals in Q1 was lower than the unusually high VC fund activity in Q4/2018, but higher than the quarterly average of 2014–2018. Non-VC-backed deals raised $247m in 57 deals, which reflects the continuing uptrend in non-VC-backed deals. VC-backed and non-VC-backed deals kept their traditional shares in Q1/2019, 56% and 44%, respectively, out of the total number of deals.

Capital Raising by Leading Sectors and Selected Technology Verticals

In Q1/2019, IT & software companies, the largest sector in the Israeli technology market, raised $660 million in 57 deals. The communications sector saw one outstanding deal—DriveNets raised $110 million — which was responsible for the increase in the capital amount this quarter.

The life sciences sector kept up stable activity in Q1/2019, with the same number of deals as in 2014–2018. Life sciences companies raised $260 million, lower than the $315 million in Q4/2018, but slightly higher than the historical average for this sector.

Marianna Shapira, research director at IVC Research Center points out: “Capital raising activity continued to be high, especially in artificial intelligence and big data, raising mid-size amounts ($5m to $20m) in A to C round series. This stems from strong follow-on investment activity—approximately 60% of the deals were made in investors’ current portfolio (a growth from about 50% quarterly average in previous years). Investors mostly concentrated on cultivating their portfolio companies, and mid-stage companies which attracted 43% of total capital inflow in Q1/2019.”

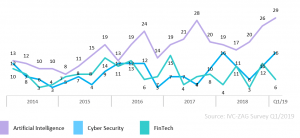

AI (Artificial Intelligence) companies continued the uptrend with a record 51 companies raising $599 million in the first quarter of 2019, compared to $369 million raised by 30 AI companies in Q1/2018. Most of the investments were made in early stage financing rounds (seed + A rounds).

Other tech verticals such as cyber security and fintech kept average levels of activity during Q1/2019.

Chart 3: Number of Deals in Selected Technology Verticals

in Early Rounds (seed + A rounds)

Q1/14–Q1/19

Methodology

This Survey reviews capital raised by Israeli high-tech companies from Israeli and foreign venture capital funds as well as other investors, such as investment companies, corporate investors, incubators and angels. This Survey is based on reports from 431 investors of which 60 were Israeli VC funds and 371 were other entities. The term “early stages” refers to high-tech companies in the process of development and not yet offering products to the market.

The survey covered total capital raised in Israeli high-tech sector, including VC-backed rounds, where at least one VC fund participated in the round, as well as deals not backed by venture capital funds. The survey includes amounts received by each company directly,includingdirect transactions performed between company shareholders. Many companies belong to more than one cluster, therefore the data regarding clusters should be viewed separately per cluster. For more on our methodology, please click here.

For additional information:

Marianna Shapira, Research Director, IVC +972-73-212-2339 marianna@ivc-online.com

About the authors of this report:

IVC Research Center is the leading online provider of data and analyses on Israel’s high-tech, venture capital, and private equity industries. Its information is used by all key decision-makers, strategic and financial investors, government agencies, and academic and research institutions in Israel.

- IVC-Online Database (ivc-online.com) showcases over 8,400 Israeli technology startups, and includes information on private companies, investors, venture capital and private equity funds, angel groups, incubators, accelerators, investment firms, professional service providers, investments, financings, exits, acquisitions, founders, key executives, and local activity of multinational corporations.

- Publications include newsletters; Daily Alerts; the digital IVC Magazine; surveys; research papers and reports; and interactive dashboards.

- IVC Industry Analytics – analysis, research and insights into the status, main trends, and opportunities related to exits, investments, investors, sectors, and stages.

ZAG- (Zysman, Aharoni, Gayer & Co.) is a leading international law firm specializing in all areas of commercial and business law and is one of Israel’s leading commercial law firms. The firm has earned its international standing due to its global presence in the US, China and England. The firm’s attorneys specialize in all disciplines of commercial law for both publicly held and private companies, with particular expertise in hi-tech, life science, international transactions, and capital markets. ZAG-S&W provides result-driven legal and business advice to its clients, addressing all aspects of the clients’ business activities, including penetration into new markets in strategic locations. In recent years, the firm has acted on a majority of the equity and debt financing transactions by Israeli technology companies on the NASDAQ. It has been the firm’s experience that the best results, those that give our clients the competitive advantage they need, are attained by coupling professional experience, global presence, and connections with the investor communities in Israel and abroad.