IVC Research Center and ZAG Q2/2019 Israeli High-Tech Capital Raising Report

17.07.2019 | ZAG Press Release

Israeli High-Tech Companies Raised $2.32 Billion in 125 Deals in Q2/2019

Key facts:

- $2.32 billion was raised in 125 deals—the highest amount in any quarter since 2013

- 10 mega deals attracted $1.26 billion—accounting for 54% of the total capital raised in Q2

- VC-backed deals accounted for 78% of the total amount raised in Q2

- IT & Software companies raised $1.02 billion in 49 deals – the highest quarterly amount since 2013

Tel Aviv, Israel. Israeli high-tech companies raised $2.32 billion in the second quarter of 2019, the highest quarterly amount since 2013. The figure was boosted by 10 mega deals (each over $50 million), that totaled $1.26 billion and accounted for 54% of the total capital raised in Q2/2019. The large transactions included two exceptional deals: a PIPE (Private Investment in Public Equity) round of $186 million raised by Elbit Systems, and $110 million raised by Cellebrite Mobile, post-acquisition by Sun Corp. The median deal amount for Q2 was $5.5 million, compared with $5 million in the same period last year and $6 million in Q1/2019.

The three largest Q2 deals totaled $670 million:

- Lemonade raised $300 million

- Monday raised $250 million

- Sentinel Labs raised $120 million

During the first half of this year, Israeli high-tech companies raised $3.9 billion in 254 deals. The amount raised marked an all-time record. The number of deals was only slightly above the 242 deals recorded in H1/2018.

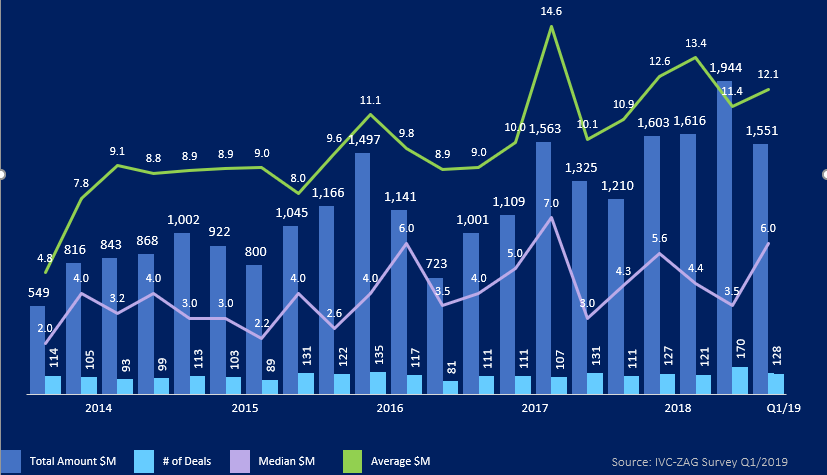

Chart 1: Israeli High-Tech Capital Raising Q1/2013–Q2/2019

According to IVC’s findings, in Q2/2019, VC-backed deals notched a record of $1.81 billion in 73 deals. VC-backed deals accounted for 78% of the total amount raised in Q2/2019, and an even higher percentage of the $1.34 billion raised in 75 deals in Q1/2019. Analyzing the distribution of VC-backed deals, IVC found that the amount raised by revenue growth companies in VC-backed deals grew dramatically to $1.12 billion. In H1/2019, VC-backed deals accounted for $3.16 billion in 148 deals, and almost doubled the amount raised in H1/2018—$1.86 billion in 142 deals.

Shmulik Zysman, Managing Partner & high-tech industry leader at ZAG/Sullivan, said: "Just when we thought the investment growth in the first quarter of 2019 had broken every record, along comes the second quarter and registers the most significant leap in the total amount raised in the last six years. Indeed, the second quarter of this year recorded the most significant leap ever in the total amount raised—$757 million, compared to the previous quarter, indicating a quarterly record and in accordance record high in H1/2019, unprecedented in recent years."

According to Zysman: "Late-stage companies raised record amounts in this quarter, and there was a degree of stability among early stage investments. On the other hand, the situation of mid-stage companies seems less favorable: funding in this quarter was lower than in recent years."

Capital Raising by Stage and Round

Israeli high-tech growth stage companies (companies in initial revenue and revenue growth stages) were exceptionally active in Q2/2019. These companies raised $2.02 billion in 70 deals—the highest total amount since 2013. IVC noted that late financing rounds accounted for $1.12 billion in 23 deals in Q2/2019—nearly three times the $414 million raised in Q2/2018.

In Q2/2019, deals larger than $20 million dominated the capital raising activity, with $1.79 billion in 29 deals compared to $932 million in 18 deals in the same period the year before. This marks the highest sum and number of deals for this category since 2013. Deals exceeding $20 million totaled $2.78 billion in 53 transactions in H1/2019. Deals exceeding $50 million during this period accounted for $1.7 billion in 15 deals, compared to $920 million in nine deals in the same period last year.

Chart 2: Israeli High-Tech Capital Raising by Deal Size and Number – Highlighting transactions under $5M, $20M-$50M, and above $50M

Capital Raising by Sector

IT & software companies excelled in Q2/2019, raising $1.02 billion in 49 deals—the highest quarterly amount since 2013.

In Q2/2019, Israeli life sciences companies raised $263 million in 27 deals. Both the number of deals and the amount raised were slightly higher compared with the quarterly average since 2013.

Investor Activity

In Q2/2019, Israeli investors made 174 investments totaling $704 million. According to IVC, this is a quarterly high since 2013. The number of investments by Israeli investors was higher compared to the quarterly average in recent years.

Foreign investors increased activity in Q2/2019 compared to previous quarters, making 441 investments totaling $1.57 billion.

Marianna Shapira, Research Director at IVC Research Center: "The second quarter of 2019 continues the same trend from recent quarters. Israeli high-tech companies are gaining access to a larger pool of capital for growth companies, especially from foreign investors. This shows growing appetite for the local market. The trend is driving valuations to new heights, presenting challenges both to the companies seeking capital and to local investors. The Q2 figures show that most early-stage companies are struggling to access investment capital. This discrepancy might be a cause for concern about the future of seed ventures in Israel. If the second half of 2019 continues with the same pace, this year will break previous records for capital volume."

Methodology

This survey reviewed capital raised by Israeli high-tech companies from Israeli and foreign venture capital funds as well as other sources, such as investment companies, corporate investors, incubators, and angels. The survey is based on reports from 458 investors, of which 60 were Israeli VC funds and 398 were other entities. The term “early stage” refers to high-tech companies in the Seed and R&D stages, not yet offering products to the market.

The survey covered the total capital raised throughout the Israeli high-tech sector, deals with participation of at least one VC fund, as well as deals not including venture capital funds. The survey includes amounts received by each company directly, including direct transactions performed between company shareholders. Many companies belong to more than one cluster, therefore the data regarding clusters should be viewed separately per cluster. For more on our methodology, please click here.

For additional information:

Marianna Shapira, Research Director, IVC +972-73-212-2339 marianna@ivc-online.com

About the authors of this report:

IVC Research Center is the leading online provider of data and analysis on Israel’s high-tech & venture capital industries. Its information is used by key decision-makers, strategic and financial investors, government agencies, and academic and research institutions in Israel.

- IVC-Online Database (ivc-online.com) showcases over 8,500 Israeli technology startups, and includes information on private companies, investors, venture capital and private equity funds, angel groups, incubators, accelerators, investment firms, professional service providers, investments, financings, exits, acquisitions, founders, key executives, and Multinational Corporations.

- Publications include newsletters; Daily Alerts; the IVC Magazine; surveys; research papers and reports; and interactive dashboards.

- IVC Industry Analytics – analysis, research and insights into the status, main trends, and opportunities related to exits, investments, investors, sectors, and stages.

ZAG is an international law firm with offices in Israel, the United States, China, and the United Kingdom. The firm’s attorneys specialize in all disciplines of commercial law for both publicly held and private companies, with particular expertise in hi-tech, life science, international transactions, and capital markets. ZAG/Sullivan provides result-driven legal and business advice to its clients, addressing all aspects of the clients’ business activities, including penetration into new markets in strategic locations. In recent years, the firm has acted on a majority of the equity and debt financing transactions by Israeli technology companies on the NASDAQ. It has been the firm’s experience that the best results, those that give our clients the competitive advantage they need, are attained by coupling professional experience, global presence, and connections with the investor communities in Israel and abroad.